Stocks To Watch For Festival Season Diwali Before September 2024 – Being able to generate the kind of money one needs to make a wise investment is a rare window offered by the India festival season. The period varies between two to three months, beginning around Ganesh Chaturthi and culminating with Diwali. Since ancient times, this time of the year has reflected favorable trends of stocks. This phenomenon is not India-specific, but rather there have been records of Santa Claus rallies happening during December in the US too. Proper early planning for the season is sure to benefit those looking to invest wisely.

Understanding the Festive Stock Phenomenon

Festive stocks open an interesting opportunity for investment before Diwali. For, the logic of investing in festive stocks lies in riding the upward momentum building up in the market in the festive season. Yet most investors have become last-minute enthusiasts of festive stock spree, thus missing the best of investment bargains. Investors are opportune now to recognize and invest in some of the promising stocks going into the forthcoming market rally.

Historically, the market has always tended to rally during the festive seasons. This usually happens because of consumer spending that increases when everybody readies themselves for celebrations. All this tends to have a bearing on investment decisions for investors.

Why start early?

One would be inquisitive as to why invest in Diwali-themed stocks way before they are due. The answer lies in the dynamics of the market. Big players and operators tend to manipulate the sentiment, which may result in overpriced stocks if you delay investment. Investing early can avoid the upward creep in buying price on time.

While it is understandable to be nave while many investors were confident of grabbing the gold or stocks such as Titan expecting sales during Diwali last year, knowledge of the market fundamentals and technicals and influence exerted by macroeconomic on these stocks is essential.

Investment Strategy in Festive Stocks

The festive stocks are approached with an investment strategy. The following are some of the key investment strategies:

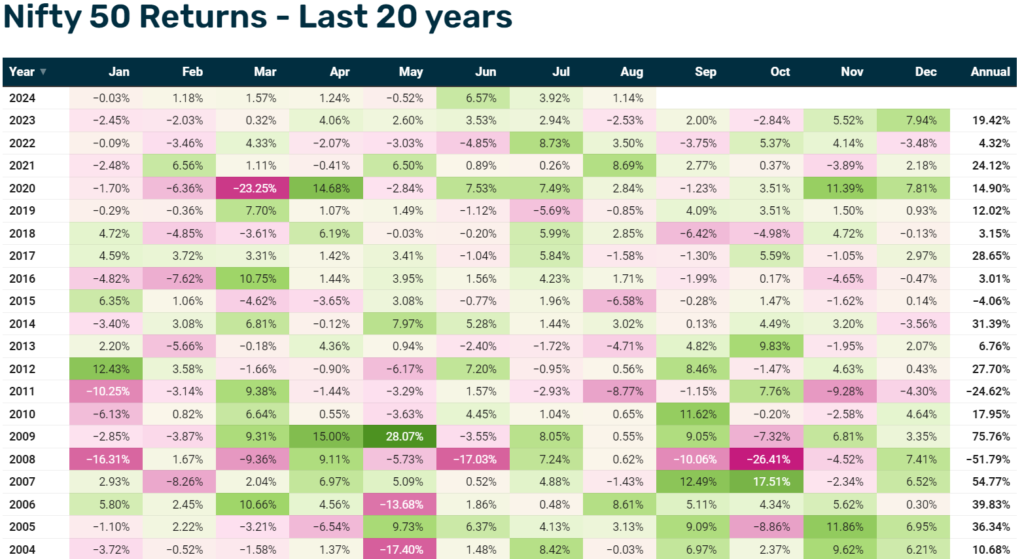

- Past Trends of Stocks Performances During this Festive Time: Are the Historical Trends Exhibited?

- Know About Market Sentiments and Consumer: Spending Habits in the Pre-festive Seasons

- Don’t Put All Your Money in the Same Basket: Invest in a Diversified Mix of Sectors that Otherwise Tend to do Well During the Festive Period.

- Define Your Objectives: Is your investment for short-term gains or long-term growth?

Sector-Oriented Opportunities

Some sectors have the most advantages during the festive season. Here are a few of them:

Paint and Decor Stocks

Commercial Buildings and Homes Most people go that little bit extra to paint and decorate their homes for the festive season. Of course, this puts a strain on paint and decor stocks. During the quarter this falls, these companies have years of history reporting handsome numbers.

Asian Paints, for example, usually turns in returns well over 15% during the festive season.

Consumer Goods and Retail

Festivals are time for consumer goods companies because spending increases during festivals. Brands that sell essential commodities, gifts, or products suited to a particular festival can expect increased sales. Any investment in the company is sure to bring in good returns.

Gold and Jewelry Stocks

Gold has always been the traditional Diwali investment, which goes. Stocks of entities like Titan, which sell gold jewelry, have always done very well. However, at the same time, there is a necessity to monitor gold prices because they significantly affect the stock.

Investment in Small Cap Stocks

There might be an onslaught of these large-cap stocks dominating the talks, but small-cap stocks do present a significant return during festive seasons. It is riskier, but while it presents a lot of these growth opportunities, it’s worth the high-risk endeavor. Companies like Jyoti Resins, which is into the adhesive market, will get on to increase their demand in this period.

Actually, small-cap stocks usually have much more room for growth than large-cap counterparts, making them attractive with high returns on the mind. And this is important with tough researches and risks ahead.

Stocks to Watch for Better Returns This Festive Season

Here are a few that may offer good returns during this festive season:

- Asian Paints: This is a stock with a history of promising returns before the festive season. Past data shows buying Asian Paints ahead of Diwali always brought returns, which last year saw returns amounting to 16% and 25% in 2021.

- Jyoti Resin: It is a high-risk-high-reward stock in the portfolio with the return value of 3x-10x. It’s showing impressive sales growth as well as the market share is expanding very rapidly.

- Titan: Titan is more or less a brand name for gold jewelry. Titan will enjoy more sales of gold on this festival season. However, investors need to be watchful since the valuation is high and that big returns are not expected.

Understanding Market Trends

The investor needs to understand that markets like Titan do not carry lots of returns due to the massive market capitalization and high price-to-earnings ratio.

But one can look for better returns through smaller-cap or mid-cap stocks, and the level of risk will become more substantial.

ALSO READ: 5 Companies Exploring High-Risk, High-Return Stocks

For example, the kind of stock that one could look for is that of Jyoti Resin, Asian Paints, etc., carries a better risk-reward ratio. The monitoring of the technicals of such counters may give one the optimal buying point.

Analyzing Titan Stocks

Titan has been one of the favorite stocks during festival season among investors. However, it needs to be exercised carefully by investors. Although it has constructed tremendous sales growth, the price-to-earnings ratio is really high, which may jeopardize huge expectations from delivering quick profits.

Higher gold prices do pump up sales for Titan, as sales of jewellery holding gold increase and more customers buy such jewelry. However, it is also important not to get too ecstatic when investments are at hand, expecting returns in millions just because the previous years seemed to pan out. It’s also important that expectations should not exceed potential reality.

Conclusion: Preparing for Investments During Diwali

Put simply, the festive season holds an abundance of investment opportunities for investors. All you have to do is understand market dynamics and make an early start. Whether it’s investing in consumer goods, small-cap stocks, or established companies like Titan, be aware of your strategies and not panicky.

As Diwali is approaching, it’s time to scrutinize each potential investment. In this fest season characterized by entrepreneurship and economic extravaganza, the correct plans will bring high returns. Begin with the preparations today and celebrate this festival with smart investment decisions that can yield great returns.

Bedava iPhone kazan Google SEO ile e-ticaret sitemizin satışları ciddi oranda arttı. https://royalelektrik.com/istanbul-elektrikci/

нарколог на дом срочно [url=https://narkolog-na-dom-krasnodar17.ru/]нарколог на дом срочно[/url] .

вызов нарколога цена [url=www.narkolog-na-dom-krasnodar16.ru/]вызов нарколога цена[/url] .

instagram viewer followers [url=https://anonimstories.com /]instagram viewer followers[/url] .

Приобретение диплома ПТУ с сокращенной программой обучения в Москве

купить диплом ветеринарного врача [url=https://server-diploms.ru/]server-diploms.ru[/url] .

аттестат 11 класс купить [url=https://orik-diploms.ru/]orik-diploms.ru[/url] .

ретроказино [url=http://www.newretrocasino-casino3.ru]http://www.newretrocasino-casino3.ru[/url] .

Можно ли купить аттестат о среднем образовании? Основные рекомендации

maminmir.getbb.ru/viewtopic.php?f=1&t=1782

купить диплом в туймазы [url=https://landik-diploms.ru/]landik-diploms.ru[/url] .

купить диплом о среднем образовании в астрахани [url=https://arusak-diploms.ru/]arusak-diploms.ru[/url] .

купить диплом поступить в вуз [url=https://russa-diploms.ru/]russa-diploms.ru[/url] .

Возможно ли купить диплом стоматолога, и как это происходит

Купить диплом о среднем полном образовании, в чем подвох и как избежать обмана?

laviehub.com/blog/kupit-diplom-541578qwem

Официальная покупка аттестата о среднем образовании в Москве и других городах

купить диплом оптометриста [url=https://server-diploms.ru/]server-diploms.ru[/url] .

Как не попасть впросак при покупке диплома колледжа или ПТУ в России