Over the last two to three years, waste management and recycling has garnered immense attention in India, by successive governments acting through the Swachh Bharat Mission, which sets a 2070 net zero emissions target. So, without much further ado, here are three promising waste management stocks that will be apt to take off with the trends really taking off, all while keeping their debt-to-equity ratio under one.

The Rising Indian Waste Management Industry

The waste management sector of India is still in its nascent stages compared to the global standard. The global market for waste management is calculated to be above $35 billion for the financial year 2022, whereas India’s market stands at a meager $5 billion. This gives a clear evidence of the scope that exists to grow the sector.

Today, India processes only 20 percent of the total waste, while leaving 80 percent unprocessed. Growing industrial activity and increased personal consumption will be accompanied by the increased production of more waste that can be recycled. Proper waste management should bring an estimated annual benefit of $624 billion by 2050 and reduce greenhouse gas emission by 44%. According to think tank on policy, Chhaya India, this sector would create 1.4 crore new jobs and millions of entrepreneurs over the next five to seven years.

Government Initiatives and Support

The Indian government has recognized the importance of improving waste management and has rolled out a number of schemes to fortify the sector. Recently, in a recent development, the government committed ₹3,000 crore for the AMRUT 2.0 scheme in setting up a 2,915 km sewage network with a treatment capacity of 5,791 million liters per day. It’s proof that the government wants to fortify the waste management sector.

ALSO READ: Stocks To Watch For Festival Season Diwali Before September 2024

Key Players in Waste Management Sector

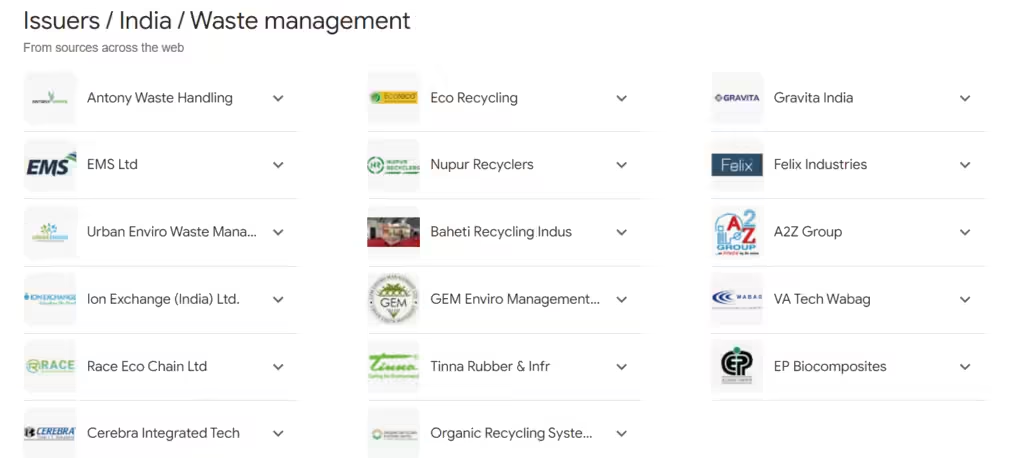

Amid the companies operating in the waste management sector, three companies especially stand out by their innovative approach and strong business model.

1. Antony Waste Handling Cell

Antony Waste Handling Cell is one of the leaders in the waste management sector and boasts of treating a lion’s share of almost more than 90% of the city’s waste. The firm has an operational history of over two decades and has been marking its presence consistently throughout the value chain in the area of waste management.

Revenue Streams: Municipal solid waste collection and transportation contracts contribute 62% of its revenue. The average duration of those contracts is approximately 7.7 years.

Processing Segments: The company strives to increase its revenue share to 60% from waste processing segments because the company believes that processing offers higher margins of 40-45% EBITDA.

- Recent Milestones: Antony Waste started the first waste-to-energy project in Maharashtra in August 2023, handling a daily 1,000 tons of municipal solid waste.

2. VA Tech Wabag

VA Tech Wabag is one of the three largest private water operators in the world and has to do with wastewater treatment solutions. The company offers a spectrum of services-from the very first design and construction of the water plant to their operation and maintenance.

- Geographic Footprint: VA Tech has penetrated over 25 countries and executed over 1,050 projects since its inception in the year 1995.

- Revenue Mix: Through its financial year 2024, engineering, procurement, and construction services comprised 81% of the total revenue, while operations and management were 19%.

- Growth Potential: The order book is seen to be around ₹16,000 crore by the end of the year. The target remains to keep a revenue-to-order book ratio at least 3x.

3. Ganesha Ecosphere

Ganesha Ecosphere is the largest PET waste recycling company in India, with an annual capacity to recycle 750 crore PET bottles. Over a period of time, the company has shifted mainly from textile business and concentrates solely on recycling.

- Supply Chain: Ganesha has developed a supply chain network of over 250 suppliers for PET bottles that are crushed into PET flakes and then converted into pellets and resins used in various industries.

- Financial Performance: The company managed to keep increasing sales by 32% in its financial year 2025 as the growth in its bottom line saw a 554% jump as raw material prices went up and squeezed the bottom line.

- Future Plans: Ganesha would focus on increasing production capacity and concentration on value-added products and thereby attaining a better market position.

Conclusion

The waste management sector of India is said to grow phenomenally based on government schemes and increasing awareness towards sustainability. Companies like Antony Waste Handling, VA Tech Wabag, and Ganesha Ecosphere stand placed pretty well to benefit from this trends. All these companies make for a good investment vehicle.

Of course, all types of investments, including waste management stocks, carry a certain degree of risk of late payment, as well as extreme market fluctuations; however, the long-term prospects for waste management stocks are bright because a more circular India will eventually imply crucial contributions from companies like these toward the future of waste management.

For readers interested in the waste management sector, additional information and further reading can be found in the description. Knowledge of the dynamics of the sector can create a wealth of insights into its massive potential for investment and growth.