Introduction

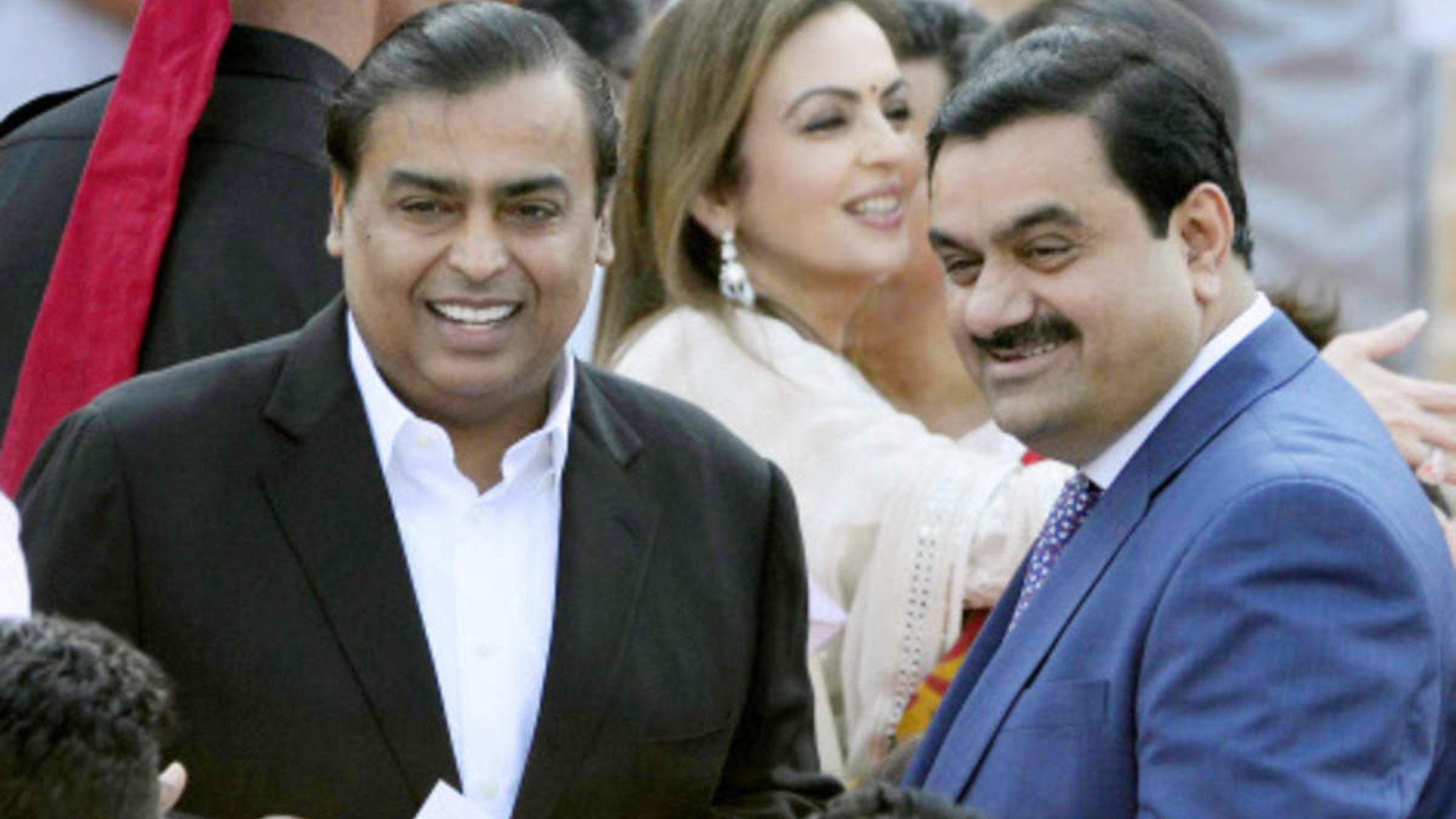

Ambani and Adani unite – In a remarkable turn of events, two of India’s most influential business magnates, Mukesh Ambani and Gautam Adani, have joined forces in a groundbreaking collaboration. Reliance Enterprises, drove by Ambani, has obtained a 26% stake in Adani Power’s task in Madhya Pradesh. This strategic move marks the first-ever joint venture between these rival billionaires and has significant implications for India’s power sector.

India’s leading businessmen, Mukesh Ambani and Gautam Adani, have recently struck a significant deal in the power sector. Adani Power, a company owned by Gautam Adani, has entered into a long-term power purchase agreement with Reliance Power, owned by Mukesh Ambani, for 20 years. The agreement is for a purchase of 1 megawatt power from Reliance Power. This deal has created quite a buzz in the power sector, and its implications are worth exploring.

The Details of the Ambani and Adani unite Deal

Ambani and Adani unite – According to Adani Power, its subsidiary, Mahan Energy, has signed a 20-year long-term agreement with Reliance Power. Mahan Energy has a total operational capacity of 2,800 megawatts, out of which 600 megawatts will be dedicated to the proposed unit. The agreement falls under the captive user policy, which is based on the Electricity Rules of 2005. To leverage the benefits of this deal, Reliance Power will need to hold equity shares in reliance1. As per the agreement, Reliance Power will invest 50 crores through equity shares, and a special arrangement will be made for the purchase of 500 megawatts of electricity between the two companies.

The Market Reaction

Ambani and Adani unite – As soon as news of this deal broke, Adani Power’s shares saw an increase of approximately 3.5% in the market. On Thursday, the company’s shares rose to ₹50,000, showing a gain of 5%. Over the past year, investors have witnessed a growth of 20.59% in Adani Power’s shares. Now, the question arises: How much boost will the power sector receive from this deal between the two giants, and what growth can we expect from Reliance and Adani Power in the coming days?

Future Prospects: Reliance and Adani Power

Ambani and Adani unite – The power sector in India is poised for significant growth with this landmark deal. Reliance Power and Adani Power, two powerhouses in the industry, have joined forces to enhance electricity generation and supply. This collaboration will not only benefit the companies involved but will also contribute to the country’s overall power sector. With this deal, both Reliance and Adani Power are expected to witness a substantial increase in their shares and market presence.

The Premium Membership Program by Risk

Ambani and Adani unite – As you continue to explore the world of business, don’t forget to stay updated with the latest news and developments. Bisk brings you a premium membership program that offers several benefits to its members. By joining the program, you gain access to a market newsletter, live chat support to get quick answers to your queries, market outlook videos with expert anchors, and much more. The premium subscription offers three plans: Silver, Gold, and Platinum, with a minimum duration of 9 months. Connecting with Bisk and availing these benefits is now easier than ever.

The Stake Acquisition

Ambani and Adani unite – Reliance Industries will hold a 26% ownership stake in Mahan Energen Ltd, a wholly-owned subsidiary of Adani Power Ltd. The acquisition involves 5 crore equity shares of Mahan Energen, each with a face value of ₹10 (totaling ₹50 crore). This stake purchase signifies Reliance’s commitment to expanding its presence in the energy domain.

Electricity Usage and Captive Use

Ambani and Adani unite – As a feature of the understanding, Dependence Businesses will use 500 MW of power produced by the Adani Power project for hostage use. Captive use refers to the consumption of power by the same entity that produces it. Reliance aims to optimize its energy requirements through this arrangement, enhancing operational efficiency.

In a groundbreaking move, Mukesh Ambani’s Reliance Industries has acquired a 26% stake in Adani Power’s project in Madhya Pradesh. This collaboration marks the first-ever joint venture between the rival billionaires, Mukesh Ambani and Gautam Adani.

Here are the key details:

- Stake Acquisition: Reliance Industries will hold a 26% ownership stake in Mahan Emerge Ltd, a wholly-owned subsidiary of Adani Power Ltd. The acquisition involves 5 crore equity shares of Mahan Emerge, with a face value of ₹10 each (totaling ₹50 crore).

- Electricity Usage: As a component of the settlement, Dependence Enterprises will use 500 MW of power produced by the Adani Power project for hostage use.

- Long-Term Power Purchase Agreement: Mahan Emerge Ltd has entered into a 20-year long-term power purchase agreement (PPA) with Reliance Industries. This agreement aligns with the captive user policy defined under the Electricity Rules, 2005.

- Business Rivalry: Mukesh Ambani and Gautam Adani, both hailing from Gujarat, have often been pitted against each other in the business world. Their interests span diverse sectors, from oil and gas to infrastructure, renewable energy, and more.

- Clean Energy Investments: While Adani aims to be the largest renewable energy producer globally, Reliance is building giga factories for solar panels, batteries, green hydrogen, and fuel cells.

The Business Rivalry

Ambani and Adani unite – Mukesh Ambani and Gautam Adani, both hailing from Gujarat, have often been portrayed as fierce competitors in the media. Their interests span diverse sectors, from oil and gas to retail, telecom, infrastructure, and renewable energy. However, despite occasional clashes, they have steadily climbed the ranks of Asia’s wealthiest individuals.

Clean Energy Investments

Ambani and Adani unite – While Adani aspires to become the world’s largest renewable energy producer by 2030, Reliance Industries is making significant strides in clean energy initiatives. Ambani’s conglomerate is constructing four giga factories in Jamnagar, Gujarat, dedicated to solar panels, batteries, green hydrogen, and fuel cells. Adani is investing in three giga factories for solar modules, wind turbines, and hydrogen electroliers.

The Unforeseen Alliance

Ambani and Adani unite – The collaboration between Ambani and Adani extends beyond business transactions. In 2022, a company formerly linked to Ambani sold its stake in news broadcaster NDTV to Adani, paving the way for Adani’s takeover. Additionally, Adani was present at the pre-wedding celebrations of Ambani’s youngest son, Anant, in Jamnagar. These personal interactions highlight the unexpected camaraderie between the two industrial giants.

Long-Term Power Purchase Agreement

Ambani and Adani unite – Mahan Energen Ltd (MEL) has entered into a 20-year long-term power purchase agreement (PPA) with Reliance Industries. Under the captive user policy defined by the Electricity Rules, 2005, this agreement ensures that Reliance holds not less than 26% ownership in the captive generating company. One unit with a capacity of 600 MW at MEL’s Mahan thermal power plant will serve as the designated captive unit for Reliance’s power needs.

Conclusion

Ambani and Adani unite – The Reliance-Adani collaboration represents a pivotal moment in India’s energy landscape. By combining their strengths, these business titans are poised to drive innovation, efficiency, and sustainability in the power sector. As the nation transitions toward cleaner energy sources, this partnership sets a precedent for future joint ventures and underscores India’s commitment to a greener future.

Disclaimer: The information is only for information purpose only. It is always recommended to consult with certified financial experts before making any investment decisions. Follow busymoneyfreak.com .

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.