In this blog, we will recommend Zero Balance Savings Accounts. By lifetime free, we mean that you do not need to maintain any balance or funds in these accounts. In 2024, many banks disabled their old balance accounts and introduced new accounts. In this Blog, we will recommend the best accounts from the old and new accounts. Let’s dive in!

Best Lifetime Free Zero Balance Savings Accounts in 2024

1. ICICI Account – My Account

One of the accounts that ICICI had was called My Account, which was a zero balance account. It became very popular at the time and we even made a separate video about it. However, ICICI disabled that account. Currently, ICICI has a basic savings bank deposit account named Onesti, which is not as great as the zero balance account. But the gap that ICICI created in the market is being filled by IDFC. IDFC is fulfilling the gap with its really good IDFC First account.

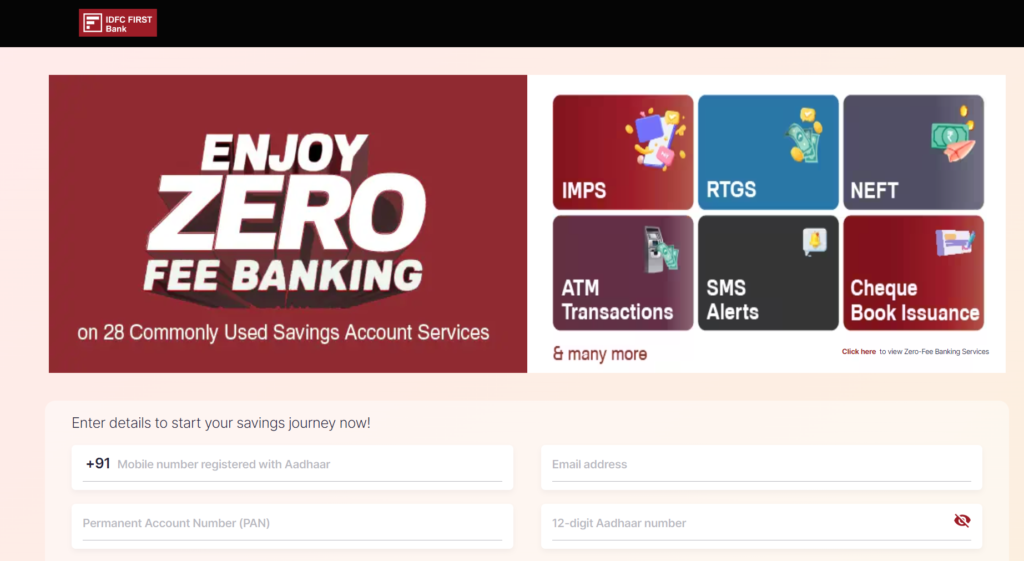

2. IDFC First – First Savings Account

IDFC First offers a first savings account that is one of the best among private sector banks. It also comes with IDFC’s digital banking experience, along with a decent range of credit cards and savings account offers. Our first recommendation is IDFC First’s first savings account. We recommended this account in 2023 as well. The first age is the name suggests, focuses on the needs of those people who do not have even a single bank account. You can open this account both offline and online, but the option to open it online is not available. Apart from being lifetime free, it also offers unlimited and free ATM transactions from any bank’s ATM.

3. IDFC First – Future First

Our next recommendation is also from IDFC, called IDFC Future First. It is also an offline-only account, focused on students and first-time employees. You can open this account at any IDFC branch. It also offers unlimited and free ATM transactions, from any bank’s ATM. In terms of interest rates, it is one of the best in the market. As you can see, IDFC offers 3% for balances below ₹1 lakh and 7% for balances above ₹5 lakh, which is one of the best among private sector banks. IDFC also provides a decent range of credit cards along with this account. If you open a basic account as well, they will upgrade your account to premium in no time.

4. Bank of Baroda – Bro Account

Bank of Baroda’s BRO account is specially targeted for students. As you can see, there is a lengthy discussion going on this community about this account. It offers complimentary airport lounge access and a platinum debit card for free if you maintain a balance of ₹10,000. However, if you do not maintain this balance, you will be charged for the debit card. I have personally used Kotak Mahindra’s 811 digital account, and I can totally vouch for its security. Everything can be operated using the dear app. This can be considered as an alternative to the Kotak 811 digital account. However, one problem with this account is that if you open the limited KYC account, you may face many restrictions. If you open the full KYC account, you will not face these restrictions. The personal Kotak app is totally worth it for its security and I can definitely recommend checking it out.

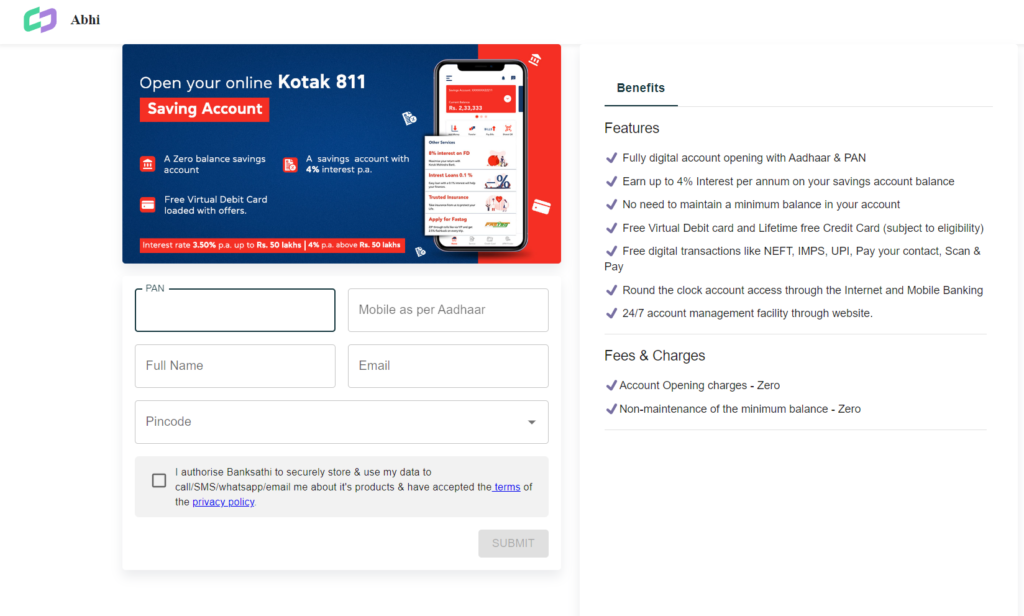

5. Kotak 811 Digital Account

Kotak 811 Digital Account stands at the forefront of modern banking solutions, offering customers a seamless and paperless approach to managing their finances. As a digital savings account provided by Kotak Mahindra Bank, the 811 account is characterized by its simplicity, convenience, and accessibility. Applicants can open an account swiftly through a user-friendly mobile app, eliminating the need for extensive paperwork. The account provides a range of features, including free fund transfers, virtual debit cards, and the ability to earn interest on savings. Kotak 811’s digital nature facilitates easy monitoring of transactions, account balances, and other financial activities, putting the power of banking directly into the hands of users. This innovative banking solution caters to the evolving needs of a tech-savvy generation, reflecting the bank’s commitment to embracing digital transformation in the financial sector.

With Kotak 811 Digital Account, banking becomes a streamlined and user-centric experience, marking a significant stride in the evolution of modern banking services. Moreover, Kotak 811 Digital Account offers an inclusive banking experience by extending its services to a wide range of individuals, including those who may not have access to traditional banking infrastructure. The account opens up avenues for financial inclusion, allowing users to enjoy the benefits of a full-fledged savings account without the constraints of physical branch visits. The digital account also integrates advanced security features, assuring customers of a safe and protected banking environment.

Kotak 811 stands out with its innovative features, such as the ability to customize transaction limits and set savings goals within the app. This personalized approach empowers users to tailor their banking experience according to their unique preferences and financial objectives. Additionally, the virtual debit card provided with the account facilitates online transactions and payments, adding to the overall convenience. The Kotak 811 Digital Account aligns with the evolving landscape of digital finance, catering to the fast-paced and dynamic lifestyle of contemporary consumers.

As a pioneer in the digital banking space, Kotak Mahindra Bank continues to redefine conventional banking norms, making financial management more efficient and accessible to a diverse clientele. Whether for everyday transactions, savings goals, or the ease of managing finances on-the-go, Kotak 811 Digital Account represents a significant leap towards a future where banking seamlessly integrates with the digital way of life.

Conclusion

In conclusion, we have recommended the top six accounts that are lifetime free in 2023. These accounts include ICICI My Account, IDFC First’s First Savings Account, IDFC First’s Future First, Bank of Baroda’s BRO Account, and Kotak 811 Digital Account. Each account comes with its own features and benefits. If you are a student or a first-time employee, these accounts are worth considering. Please note that the availability and terms of these accounts may vary, so it is advisable to check the bank’s website or visit the nearest branch for more information. Do not hesitate to join the discussion on the B community for more insights from other users. Remember, opening a bank account is an important decision, so choose wisely!

Disclaimer: The information is only for information purpose only. It is always recommended to consult with certified financial experts before making any investment decisions. Follow busymoneyfreak.com .