In the ever-evolving world of telecommunications, Bharti Airtel has emerged as a true industry titan, commanding a significant presence not only in India but also across Asia and Africa. As the telecom landscape continues to shift, Airtel has consistently proven its ability to adapt and thrive, cementing its position as one of the most promising investments in the sector.

The Bharti Airtel Advantage: Leveraging Postpaid Customers and Data Monetization

One of Airtel’s key strengths lies in its vast base of postpaid customers, who provide a steady and predictable stream of revenue. Unlike prepaid users, postpaid customers are often more loyal and less likely to churn, offering Airtel a distinct advantage in terms of earnings visibility and stability. Moreover, the company’s focus on data monetization has been a significant driver of its growth, as it capitalizes on the surging demand for mobile data services in India.

India’s telecom market is renowned for its highly competitive landscape, but Airtel has managed to navigate these challenges with remarkable agility. The country boasts some of the world’s most affordable data plans, with the cost of 1GB of internet data averaging just 26 cents, compared to $2.50 or more in countries like Australia, France, Brazil, and Spain. This has created a unique opportunity for Airtel to strengthen its position and drive further growth.

Airtel’s Diversification: Expanding Beyond Wireless Services

Airtel’s vision extends far beyond its core wireless business. The company has been actively diversifying its operations, venturing into cloud communications, data centers, and security services. This strategic move not only diversifies Airtel’s revenue streams but also positions it as a comprehensive technology solutions provider, catering to the evolving needs of its customers.

The company’s foray into the broadband market presents another significant growth opportunity. With India’s broadband market still largely underexplored, Airtel’s expansion in this domain can unlock substantial potential in the years to come.

Robust Financials and Analyst Optimism

Fundamentally, Bharti Airtel is one of the best-performing companies in the industry. The company is poised to reach an all-time high of ₹1.8 trillion in sales by the end of the fiscal year 2024, driven by its successful 5G expansion. This growth trajectory, coupled with the company’s strong financial position, has garnered the attention of industry analysts and experts.

According to the latest data, out of 33 analysts covering Airtel, 23 have issued a “buy” recommendation, with the highest target price of ₹1,575 set by Jefferies. This overwhelming analyst optimism underscores the market’s confidence in Airtel’s ability to capitalize on the industry’s evolving dynamics and deliver consistent shareholder value.

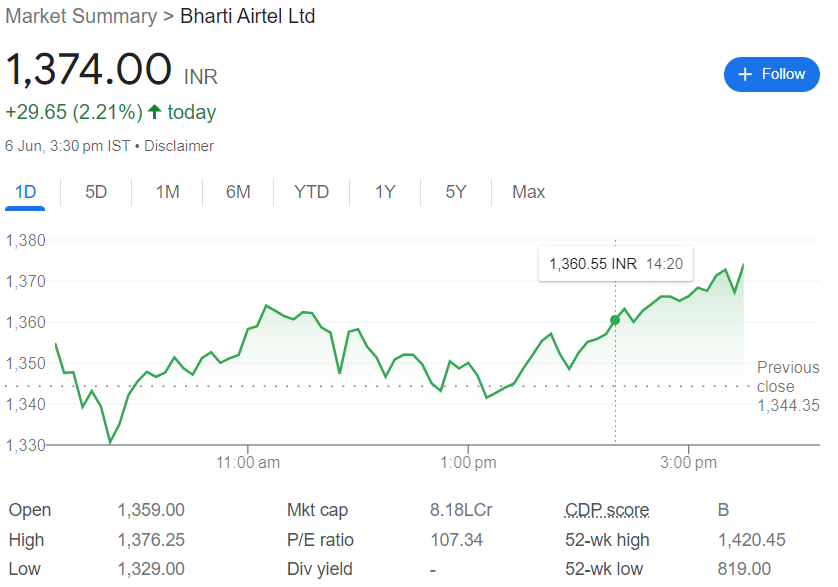

Technical Analysis: Airtel Shares Upward Momentum

From a technical standpoint, Airtel’s stock has been in a strong uptrend, with the majority of its monthly closes in the past 12 months occurring in the green. This sustained positive momentum is a testament to the market’s confidence in the company’s performance and future prospects.

The stock’s price action has consistently respected its rising trend line, and the momentum indicators, such as the RSI and MACD, are also signalling strength. This technical setup suggests that Airtel’s upward trajectory is well-supported, and investors may consider adding to their positions on dips or entering new positions above the critical support level of ₹1,327.

Retail Investor Sentiment and Contrarian Views

The positive sentiment surrounding Airtel is not limited to industry analysts and experts. Retail investors on platforms like Stocktwits have also expressed their enthusiasm for the stock, citing the company’s robust financials, 5G expansion, and industry-leading position.

However, it’s important to note that not all market participants share the same bullish outlook. Some, like Kush Ghodasara, have a contrarian view, suggesting that the stock may see a pause in its recent rally at these elevated levels. While this perspective provides a balanced outlook, long-term investors may still find Airtel’s fundamentals and growth prospects appealing, especially on any potential dips.

Decoding the Quarterly Performance

In the ever-evolving landscape of the telecom industry, Bharti Airtel’s recent quarterly results have painted a mixed picture, showcasing both areas of strength and challenges. As we delve into the key highlights, it’s essential to understand the nuances behind the numbers and the strategic implications for the company’s future.

India Operations: Solid Performance

Bharti Airtel’s India operations have demonstrated a robust performance in the fourth quarter of the fiscal year. Revenues from the Indian market grew by an impressive 12.9%, while the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin expanded by 56 basis points. This growth can be attributed to several factors, including a rise in ARPU (Average Revenue Per User) from ₹193 to ₹209, as well as an increase in 4G and 5G data customers and overall mobile data traffic.

The company’s focus on strengthening its network coverage and connectivity, particularly in rural areas, has also played a crucial role in driving this performance. Bharti Airtel reported the rollout of over 10,500 towers in the quarter and a total of 43,102 towers throughout the fiscal year, underscoring its commitment to enhancing the customer experience.

Consolidated Performance: Challenges Amid Devaluation

At the consolidated level, Bharti Airtel’s performance was impacted by a significant one-time event – the devaluation of the Nigerian currency, the Naira. This currency devaluation led to a 31% decline in the company’s net income after exceptional items, overshadowing the otherwise positive trends in the business.

However, it’s important to note that the company’s overall performance for the full fiscal year remained strong, with revenues growing by 7.8%, EBITDA increasing by 10.2%, and EBIT (Earnings Before Interest and Taxes) rising by 11.5%. Profit before tax also saw a healthy 17.5% year-over-year growth, indicating the underlying resilience of the business.

Africa Operations: Navigating Currency Headwinds

Bharti Airtel’s operations in Africa, which contribute approximately 29% of the company’s total revenue, were also affected by the Nigerian currency devaluation. However, the company’s performance in the African market remained strong, with revenues growing by 23.1% in constant currency terms, showcasing the region’s growth potential.

The company’s focus on expanding its network coverage and connectivity in Africa, mirroring its efforts in India, has been a key driver of this performance. Bharti Airtel’s commitment to investing in infrastructure and enhancing the customer experience across its geographical footprint underscores its strategic vision for long-term growth.

Dividend and Future Outlook

Amidst the mixed results, Bharti Airtel has declared a dividend of ₹8 per fully paid-up share, demonstrating its confidence in the company’s financial position and its ability to reward shareholders. This decision reflects the management’s belief in the company’s long-term prospects and its commitment to creating value for its stakeholders.

Looking ahead, Bharti Airtel’s management has expressed its intention to further increase ARPU, with a target of reaching ₹300, which they believe is still well below the global average. This strategic focus on driving ARPU growth, coupled with continued network investments and operational efficiency, positions the company for sustained growth in the future.

Conclusion: Airtel’s Promising Future

Bharti Airtel’s journey in the telecom industry has been nothing short of remarkable. With its strong foothold in the postpaid segment, successful data monetization strategies, and diversification into new business areas, the company has positioned itself as a formidable player in the rapidly evolving technology landscape.

Supported by robust financials, analyst optimism, and a favourable technical setup, Airtel’s stock appears poised for continued growth. While contrarian views and market volatility may present short-term challenges, the company’s long-term prospects remain highly promising, making it a compelling investment opportunity for those seeking exposure to India’s thriving telecom sector.

Bharti Airtel’s Q4 results have showcased the company’s ability to navigate through challenging circumstances, such as the Nigerian currency devaluation, while maintaining a strong performance in its core Indian market. The company’s focus on network expansion, digital transformation, and strategic pricing decisions underscores its commitment to delivering value to its customers and shareholders.

As the telecom industry continues to evolve, Bharti Airtel’s ability to adapt, innovate, and capitalize on emerging opportunities will be crucial in determining its long-term success. Investors and analysts will closely monitor the company’s progress in the coming quarters, as it navigates the dynamic landscape and positions itself for sustained growth and profitability.

Disclaimer: The information is only for information purpose only. It is always recommended to consult with certified financial experts before making any investment decisions. Follow busymoneyfreak.com .