Tata Motors has emerged to be a very promising auto company, hailed for its progressive and innovative strategy for business. This article will talk about Tata Motors’ share price targets from 2024 to 2040. We would analyze the growth potential of this company and present market dynamics. In this post, we will understand in detail what factors can lead to such tremendous growth and what are the risks which investors should be aware of.

Tata Motors has long been an important part of the automobile sector, particularly in India. Recently, the announcement of its demergering is about to unlock further value for the company and bring more operational efficiency. The present article discusses in detail the business segments, financial performance, and prospects concerning Tata Motors.

Tata Motors Demerger Announcement

Tata Motors recently announced its intention to break up into two separate entities. This strategic move was to separate its commercial vehicle business from its passenger vehicle segment that includes electric vehicles and luxury brand Jaguar Land Rover. The demerger could take a period of 12-15 months, subject to all statutory clearances. The idea was to facilitate both segments to basically focus on their growth and operational strategies independently.

Overview of Tata Motors

Tata Motors is one of India’s largest automobile companies. It has built a brand name as a leader across various segments such as passenger vehicles, commercial vehicles, and electric vehicles. The company has innovated the product line with changing market requirements and needs of consumers from time to time.

With rapid growth in the automobile industry pegged to technological changes and increasing consumer awareness, Tata Motors becomes very well-placed. An investor can, therefore, look at the performance of the company in the past and the prospects in the future to make a conscious decision.

Inpatient since 1945, Tata Motors happens to be one of India’s leading commercial vehicle manufacturing companies. The overall market share for commercial and passenger vehicles runs into quite a significant proportion. During FY2023, the company recorded 41.7% in terms of the retail market share of commercial vehicles and ranked third in passenger vehicles with a market share of 13.5%.

Passenger Vehicle Market

The passenger vehicle market of India has gone up to $32.7 billion in 2021, with an estimate to grow up to $54.84 billion by 2027, thereby recording a close-to-8% CAGR. This shall be the time when the EV sector is also moving northwards; the sales volume may register high growth in upcoming years.

Tata Motors Market Overview

The Indian automobile industry is an integral part of the country’s economy. This sector contributes around 7.1% to the GDP and 8% to total exports. In 2023, India ranked third in world automobile production, with the market valued at more than $222 billion. The segment of commercial vehicles recorded outstanding growth, which was depicted from the wholesale figures growing by 34 percent over the comparable period of the previous fiscal year.

Key Management Personnel

The leadership team at Tata Motors also acts as the steering committee that enables the company to meet its strategic objectives. The chairman of Tata Motors, Mr. Natarajan Chandrasekaran, has responsibilities cutting across various other companies of the Tata Group. Mr. Girish Wagh is the executive director who is involved in the company’s risk management and corporate social responsibility-related activities.

Financial Performance Of Tata Motors

Tata Motors has shown impressive growth in its finances over the last couple of years. It has improved considerably in revenues and profitability, such that, on a year-on-year comparison, it is up 13% in revenues and 218% in profitability. The debt-to-equity ratio is improved, indicating more reliance on equity financing.

Key Financial Metrics

- Net Profit Margin: Improved significantly, reflecting better operational efficiency.

- Debt Service Coverage Ratio (DSCR): Improved, indicating the company is in a better position to service its debt.

- Revenue from Commercial Vehicles: The revenue for Q4 of FY24 stood at ₹21,600 crores, which was the highest ever.

Segmental Performance Of Tata Motors

Tata Motors operates through commercial vehicle, passenger vehicle, and electric vehicle businesses. Of these, each segment has different strengths and weaknesses. All of these contribute to the bottom line in their own ways.

Strengths

- Commercial Vehicles: The Company posted revenue of ₹8,800 crores in FY24, a steady growth.

- Electric Vehicle Deployment: More than 1,700 electric buses have been deployed, reaffirming Tata Motors’ leadership in the EV space.

- Sales Volume: FY24 was the best year for the passenger and electric vehicle segment for sales of 573 units.

Weaknesses

- The decline in the market share of the domestic commercial vehicle market from 41.7% in FY23 to 39.1% in FY24, and increasing EV penetration while keeping rising costs in control to drive margins, are concerns for this company. Past Returns and Future Prospects

- Tata Motors has actually had quite impressive returns over the years. The stock price is up 81% in one year, 204% in three, and a whopping 438% in five. Fundamentals are still very good, and the credibility record of the company is very high.

- Though Tata Motors looks very attractive as an investment avenue, one should not forget to first assess his risk-proximity levels, financial goals, and required time horizon. Further value may get unlocked with the de-merger. However, continuous updates regarding market trends and company performance are of essence.

Tata Motors Share Price Target (2024-2040)

| YEAR | Share Price Target (In Rupees) |

| 2024 | 1050.45 |

| 2025 | 1500.76 |

| 2026 | 1925.12 |

| 2027 | 2312.08 |

| 2028 | 2752.32 |

| 2029 | 3166.25 |

| 2030 | 3673.18 |

| 2040 | 5000 |

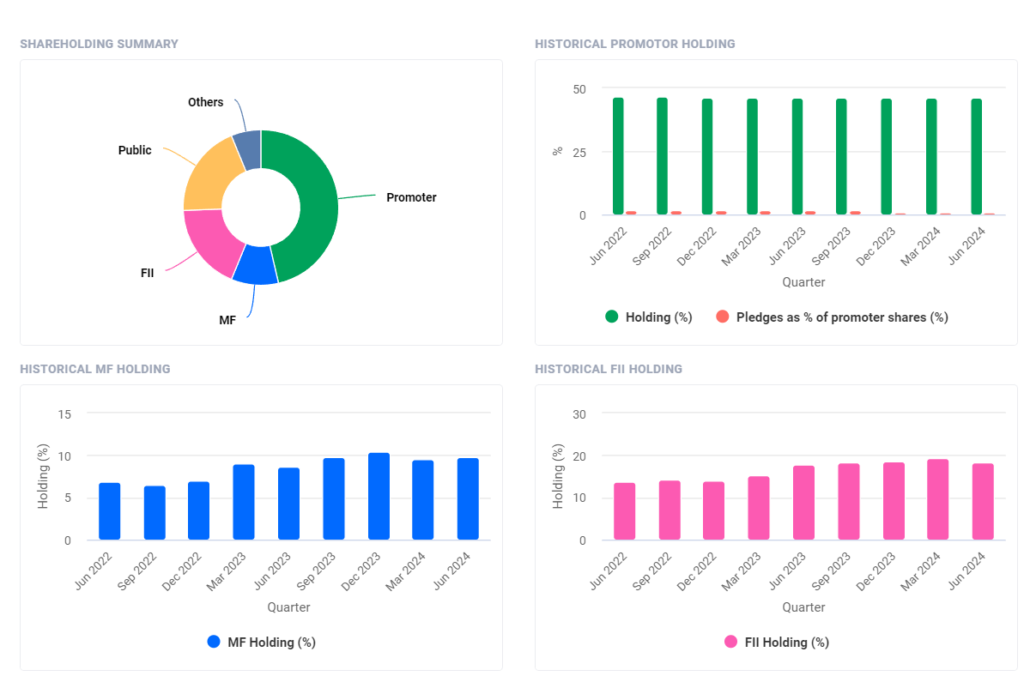

Tata Motors Ltd. Latest Shareholding Pattern – Investors Types And Ratios

Growth Prospects in 2024

2024 is the year that will bring splendid returns for Tata Motors. The target price given by experts for this company is ₹1,000,000, inspired by its leading market position and a line of new product launches. On the management side, commitment to increasing market share in different categories is likely to drive this growth.

- Continuous product up-gradation and new model launches

- Market presence building and customer satisfaction.

- Infrastructural and technological investments of a strategic nature.

Market Performance Anticipated in 2025

In the year 2025, Tata Motors will be seen continuing its upward trajectory. Its first price target would be as high as ₹1 with the subsequent target at ₹10. The main force behind this rise can be ascribed to various management strategies adopted and implemented by the Company along with product diversification.

The important factors contributing to such growth are:

- Increasing demand for electric vehicles

- Partnerships and collaborations to develop the product further

- Invest in R&D for new technology innovation

Financial Restructuring and 2026 Targets

Tata Motors targets financial solidity by the year 2026 by reducing the level of its debt. The company has been taking serious measures regarding liability management, which may lead to a substantial share price appreciation. A target price of ₹2,000,000 is expected, according to many analysts, considering the improved outlook for the financials of the company.

Management plans include:

- Gradual reduction in the level of debt over the next three to four years.

- Operational efficiency to enhance profitability

- Revenue enhancement through investment in high return projects.

Innovation and Market Positioning: 2027

Tata Motors would continue its innovation spree in the year 2027. The Company is known to be spending substantially on research and development to keep pace with innovating market conditions. The forecasted targets for the company in this year would be ₹1,000,000 and ₹1,500,000, subject to the successful development of products and market penetration.

The factors that would support this growth will be as follows:

- Improved product offerings that cater better to customer requirements.

- Support of the Tata Group, which will make doing business easier.

- Creation of an integrated ecosystem across Tata Group companies.

Long-term vision – 2030 Targets

Now, consolidating this for 2030, large growth is the target for Tata Motors, starting from a conservative estimate of about ₹3,000,000 to ₹5,000,000. This strategic aspiration can therefore find a place in its commitment to making the automotive industry sustainable and innovative.

Some of the key strategies could be:

- Growth in the electric vehicle segment, in response to its demand

- Acquisitions of competitors for increasing market share and capability

- Investing in sustainable manufacturing processes

Future Outlook: 2040 Targets

Looking forward to the year 20140, Tata Motors expects to consolidated market leadership with an approximate marker of ₹15,000,000. This shall underline the strong growth momentum taken by the company and the strategic position occupied by it in this sector.

The long-term targets shall be achieved through the following at Tata Motors:

- Continuous investing in innovation and technology

- Building customer relationships and brand loyalty

- Adapting to market trends and consumer preference

Risks and challenges

While its growth potential appears promising, there are intrinsic risks involved that investors need to be aware of. Rising competition in the automobile space is one key threat. Innovation is continuously required by Tata Motors if it has to hold its market share.

The second concern relates to its leveraged position. If Tata Motors fails to contain its high level of debt, servicing interest on it could be a challenge and in turn affect its growth prospects.

Conclusion

The investment case that Tata Motors offers is very strong, with huge growth in the forecasted period up to 2040. Strategic plans and actions driving innovation, which equity shareholders could back through de-gearing, are likely to be crucial for meeting the targeted goals. However, these need not deter investors from market competition risks and financing or management risks.

Detailed research and consultation from financial advisors must always be undertaken before any type of investment. The future for Tata Motors looks bright, and stakeholders will keenly watch its journey within the industry of automobiles.

Disclaimer: The information is only for information purpose only. It is always recommended to consult with certified financial experts before making any investment decisions. Follow busymoneyfreak.com .