The Changing Landscape of Tax Filing

Understanding the New Tax Regime vs the Old Tax Regime 2024 – As we approach the end of the financial year, the topic of tax filing becomes increasingly relevant. Many salaried individuals turn to the internet for advice on how to save taxes, and every year, videos flood the online space, claiming to offer the best strategies to save money. However, this year is different. If you’ve been following our videos or any other educational content, you may have learned that investing in mutual funds, equity link saving schemes, NPS, life insurance, and health insurance can help reduce your tax burden. Traditionally, these investments were made at the end of March to maximize tax savings. But now, the game has changed. The government has introduced a new tax regime that may make it more beneficial for salaried individuals to rethink their tax-saving strategies.

The Purpose of Deductions and Tax Incentives

Before we delve into the details of the new tax regime, let’s understand why the government introduced deductions and tax incentives in the first place. The main objective was to incentivize individuals to invest in assets like NPS, equity link saving schemes, and insurance to improve their financial well-being in the long run. The government believed that by providing tax rebates, individuals would be motivated to build a secure future. Many people realised that by making intelligent investments and utilising deductions, they could reduce their tax liability and potentially receive refunds. It seemed like a win-win situation for both citizens and the government.

Exploring the Old Tax Regime

Under the old tax regime, several deductions were commonly discussed. The most popular ones included Section ATC, which allowed investments in equity-linked savings schemes (ELSS), NPS, and home loan principal repayments. Additionally, Section 80E covered interest on education loans for up to 8 years, while Section 80D provided deductions for health insurance premiums. Home loan interest and House Rent Allowance (HRA) were also considered significant deductions.

An Introduction to the New Tax Regime

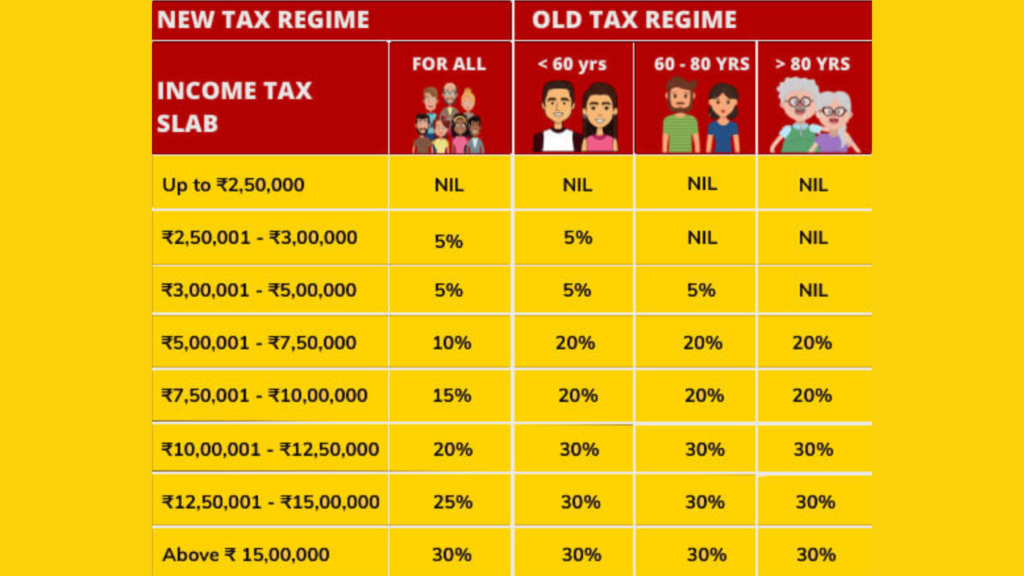

Now, let’s examine whether the new tax regime or the old tax regime is more advantageous for you. To do this, we’ll visit the official income tax website and utilise their income tax calculator. By comparing your salary under both regimes, you can make an informed decision. It’s important to note that the new tax regime does not allow for any deductions, while the old tax regime still provides deductions for various investments and expenses. However, as we analyse the calculations, you’ll discover that the new tax regime may prove to be more attractive for most individuals.

Calculating Tax Liability

Let’s consider an example to illustrate this point. Imagine a salaried individual earning 10 lakh rupees annually. Under the old tax regime, this person might invest around 1 lakh rupees in ELSS, term insurance, PF, and housing loan repayments, claiming a deduction of 1 lakh out of the total available 1.5 lakh rupees under section 80C. Additionally, they may claim deductions for medical insurance premiums (up to 15,000 rupees) and home loan interest (up to 50,000 rupees). After considering all deductions, this individual would still end up paying a total tax of 72,180 rupees.

Now, let’s examine the same person’s tax liability under the new tax regime. As no deductions are allowed, their taxable income remains the same, resulting in a significantly lower tax liability. By using the income tax calculator on the official website, you can easily compare the two scenarios and determine which tax regime is more favourable for your specific circumstances.

The Benefits of the New Tax Regime

According to the income tax calculator, the new tax regime offers lower tax rates for various income brackets. For example, individuals earning between 5 to 6 lakhs previously paid a 10% tax, whereas under the new regime, they will only pay 5%. Similarly, those earning between 7.5 to 9 lakhs will now pay 10% instead of the previous 15%. These reduced tax rates make the new tax regime more attractive for the majority of individuals.

The income tax calculator also provides a table that indicates the amount of deductions required for the old tax regime to become more advantageous. As income increases, the required deductions also increase significantly. This means that for most individuals, it is unrealistic to claim enough deductions to make the old tax regime a better option.

The Government’s Motivation

Now, you may be wondering why the government has introduced this new tax regime and made it more beneficial for individuals to opt for it. There are a few reasons behind this change. Firstly, the government noticed that many people were claiming fake deductions, and the advanced technology used by the income tax department has made it easier to identify such fraudulent activities. Therefore, it is no longer advisable to attempt to claim deductions that you are not entitled to. Secondly, the government realised that even with the existing deductions, people were still paying higher taxes overall. By reducing tax rates and eliminating deductions, the government aims to simplify the tax filing process and ensure that individuals pay their fair share without unnecessary complications.

The Importance of Financial Discipline

While the new tax regime may seem advantageous, it does come with some challenges. With the removal of tax incentives for investments and deductions, individuals are now responsible for their financial discipline. It is crucial to set aside emergency funds, make intelligent investments, and obtain the necessary insurance coverage to secure a prosperous future. You now have the freedom to make financial decisions based on your own financial goals and aspirations.

It’s essential to understand that the responsibility lies with each individual to ensure their financial well-being. The government has simplified the tax filing process, but this should not be interpreted as an excuse to neglect financial planning. By taking control of your financial future, you can make the most of the new tax regime and secure a better life for yourself and your loved ones.

Conclusion

In conclusion, the new tax regime offers reduced tax rates and eliminates the need for various deductions. For the majority of individuals, this regime proves to be more beneficial, as the potential tax savings from deductions under the old tax regime are often outweighed by the increased tax rates. By utilising the income tax calculator on the official website, you can determine which tax regime is best suited to your financial situation. It is important to embrace financial discipline and make informed decisions to ensure a prosperous future. With the government’s changes, you now have the opportunity to take charge of your financial well-being and secure a brighter tomorrow.

Disclaimer: The information is only for information purpose only. It is always recommended to consult with certified financial experts before making any investment decisions. Follow busymoneyfreak.com .