The Usha Financial Services IPO has already made a lot of noise in the market as it opens for subscription on October 24, 2024. At a price band of ₹160 to ₹168 per share, this SME IPO looks forward to raising ₹98 crore through a fresh issue of 58.6 lakh equity shares. The blog will go into all details of the Usha Financial IPO – how it performed, how healthy its financials are, and what investors need to look out for before subscribing.

Key Information for Usha Financial Services IPO

Knowledge of the information associated with an IPO is often said to be the key in making informed investor decisions. Here are a few points to understand about an important recent IPO:

Opening Date: Usha Financial Services IPO. It would open on October 24, 2024

Closing Date: It would close on October 28, 2024

Price Band: ₹ 160 to ₹ 168

Lot Size: It has a Lot Size of 800 equity shares, which translates to a minimum investment of ₹134,400 for each retail investor- Total Issue Size: ₹98 crore

- Listing Venue: NSE SME

- Allotment Date: Expected on October 29, 2024

- Listing Date: Expected on October 31, 2024

Grey Market Premium ( GMP ) and Current Market Sentiment

The GMP for Usha Financial Services stands at ₹46 and gives an idea of a listing gain of 26%, though one needs to understand that GMP does vary and must be taken as a prediction rather than confirmation.

Usha Financial Services IPO GMP

An increasing GMP of Usha Financial Services has gained attention in recent times, especially when this GMP has crossed as much as ₹500 per share, with strong market sentiments behind it:

GMP increased from ₹50 to ₹500 in the short span of a few days. It reflects rising demand for shares. That GMP suggests that perhaps these shares would list with significant profit over the issue price.

ALSO READ: An in-depth overview of New IPO Afcons Infrastructure Limited 2024

About Usha Financial Services

Usha Financial Services is a registered non-banking financial company with the Reserve Bank of India, which was established in 1995. The company deals with a wide range of lending solutions for other NBFCs, corporates, MSMEs, and individuals, mainly focusing on women entrepreneurs. For nine years now, it has established a strong reputation in the lending industry.

Business Model and Operations

Usha Financial Services is an NBFC company incorporated in the year 1995. The company is involved in primary financial activities such as lending to other NBFCs, corporates, MSMEs, and other individuals. This company majorly operates with two of its major business lines that include enabling women entrepreneurs and funding electric vehicles.

Usha Financial IPO Business Lines

There are two types of business models that the company is using in its business.

- Retail Lending: Loans offered directly to a consumer and small business client.

- Wholesale Lending: Lending to other financial institutions or large business customers.

Financial Performance Overview

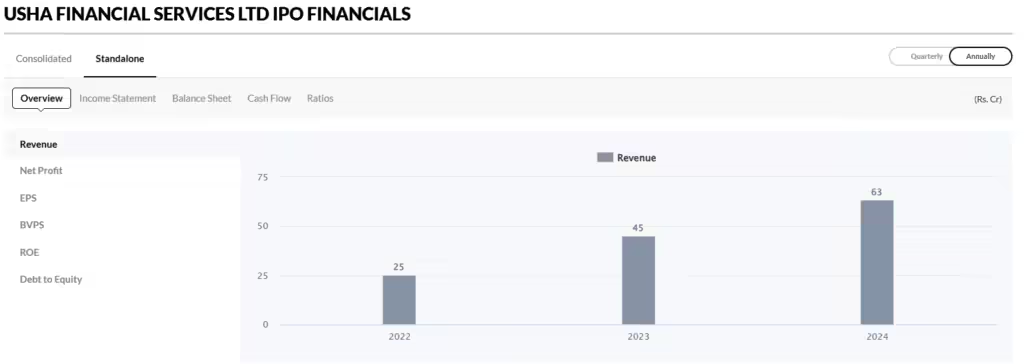

This potentiality of the IPO needs to be measured through the analysis of the financial health of Usha Financial Services. It is indeed growing remarkably:

- Revenue Growth: Revenue for FY 2023 was at ₹46 crore, and for FY 2024, at ₹66.4 crore with a growth rate of 39%.

- Profitability: Profitability also improved well enough to suggest a solid financial performance of the company.

Assets and Revenue

Assets

- The company had reported total assets of approximately ₹335 crores in FY 2024.

- Revenue ₹63 crores as on FY 2024 which is a good growth rate.

Profitability Indicators

Profit After Tax The profit after tax of the company has been in the range of ₹13.44 crores for FY 2024.

Debt to Equity Ratio

The debt equity ratio is about 1.7 at present, which is a very debt-based setup, and this goes along with the case for financial services companies.

- Price to Earnings Ratio: At 19 times, PE is pretty fair compared with the industry averages.

- Proceeds from this IPO would be used to finance some strategic initiatives.

- Augmenting capital base that supports growth

- Invest in efficiency-enhancing technologies in its operations

- Fund general corporate purposes to build on its lending book.

Utilization of IPO Proceeds

The proceeds raised from this IPO will be utilized mainly for:

Augmentation of Capital Base: The lending operations of the company need a strong capital base. General Corporate Purposes: The remaining amount will be utilized for various business purposes in the company.

Investment Considerations

Investment in an IPO also carries its own set of risks and rewards. Few points that investors must consider are as follows:

- Market Volatility: The financial markets are unstable, and the stock market may fluctuate.

- Competitive Scenario: The NBFC space is highly competitive, and this might affect the company’s market position in Usha Financial Services.

Growth Opportunities: The increase in MSME finance and green finance opportunities presents a unique growth opportunity.

KPIs

Understanding the KPIs of the company can be used to understand the overall performance of the company in terms of operational efficiency.

- ROE: At 9.29%

- ROCE: At 12.02%

- Debt to Equity Ratio at 1.7, appropriate for a financial institution.

- EPS (Earnings Per Share): Before IPO: 8.47; post IPO it is expected to hike at 9.28 EPS.

Market Competition

The NBFC space in India is very competitive and Usha Financial Services is very well placed to leverage its strengths. The focus of the company on women entrepreneurs and sustainable initiatives like financing electric vehicles puts it ahead of most of its competitors.

Investment Factors

There are opportunities and risks from the Usha Financial Services IPO. Here are some considerations:

Opportunities

- MSME financing and green financing initiatives with growing demands.

- Service value addition through strategic tie-ups of banks and other financial institutions.

Risk

- Market volatility may bring impact on the stocks post-listing.

- The higher competitive level of the NBFC sector would affect the profitability margin

Conclusion

Usha Financial Services IPO seems one such interesting opportunity for investor those who want to seek out the growing NBFC space. The company having operations on women entrepreneurs and an upward growth in the working has been placed for any long-term growth. The Usha Financial Services IPO is an attractive investment opportunity for any participant with an interest in the NBFC sector. The company affords a sound business model, impressive financial performance, and a serious commitment to empowerment benefits provided to the under-serviced markets. Growth indeed seems to be very imminent here. However, the investor seeking to participate in the issue has to do all his proper research and understand why they are investing.